Following my previous post on EDF’s woes and their impact on the European market, here’s a list of topics, both practical and political, that the company needs to deal, and their domestic impact in France.

Corrosion issues. 12 plants, mostly the more modern ones, have been stopped due to cracks in pipes. How quickly the problem can be solved will largely determine how much electricity EDF can produce this year, and in future years. A friend at EDF tells me that the issue has been identified and a specialized (Italian) firm that can repair/replace the pipes has been found.

Flamanville. The only new nuclear plant in construction in France, it has been beset by delays and cost overruns. When the decision to build it was taken in the 2000s (with final approval in 2007), it was expected to be ready by 2012 and be the first of a long series of next-generation plants that would have replaced the existing fleet well before they got too old. Now, ten years after the expected date, and with roughly 4 times the initial budget spent, the plant is still not ready and it’s still not completely clear yet when it will be (current EDF announcements point to mi-2023 at best - see the detailed wikipedia page in French). The cost overruns on that single plant are material on their own (in the range of 15 billion euros), but even more importantly, the problems during the construction of Flamanville (and the parallel issues on Olkiluoto in Finland, Hinckley Point in the UK and to a lesser extent Taishan in China) are generating massive doubts as to the ability of EDF to build more EPRs in France or elsewhere. The parallel problems at Hinckley Point (with more cost overruns announced, which need to be fully borne by EDF under the arrangements with the UK government, which has offered the plant a favorable CfD contract) also raise even more questions about the economics of such projects, especially in a world where there now are cheaper available alternatives for large-scale decarbonated power. So: can EDF complete Flamanville and Hinckley Point C? At what price? Can it provide credible plans for other nuclear plants?

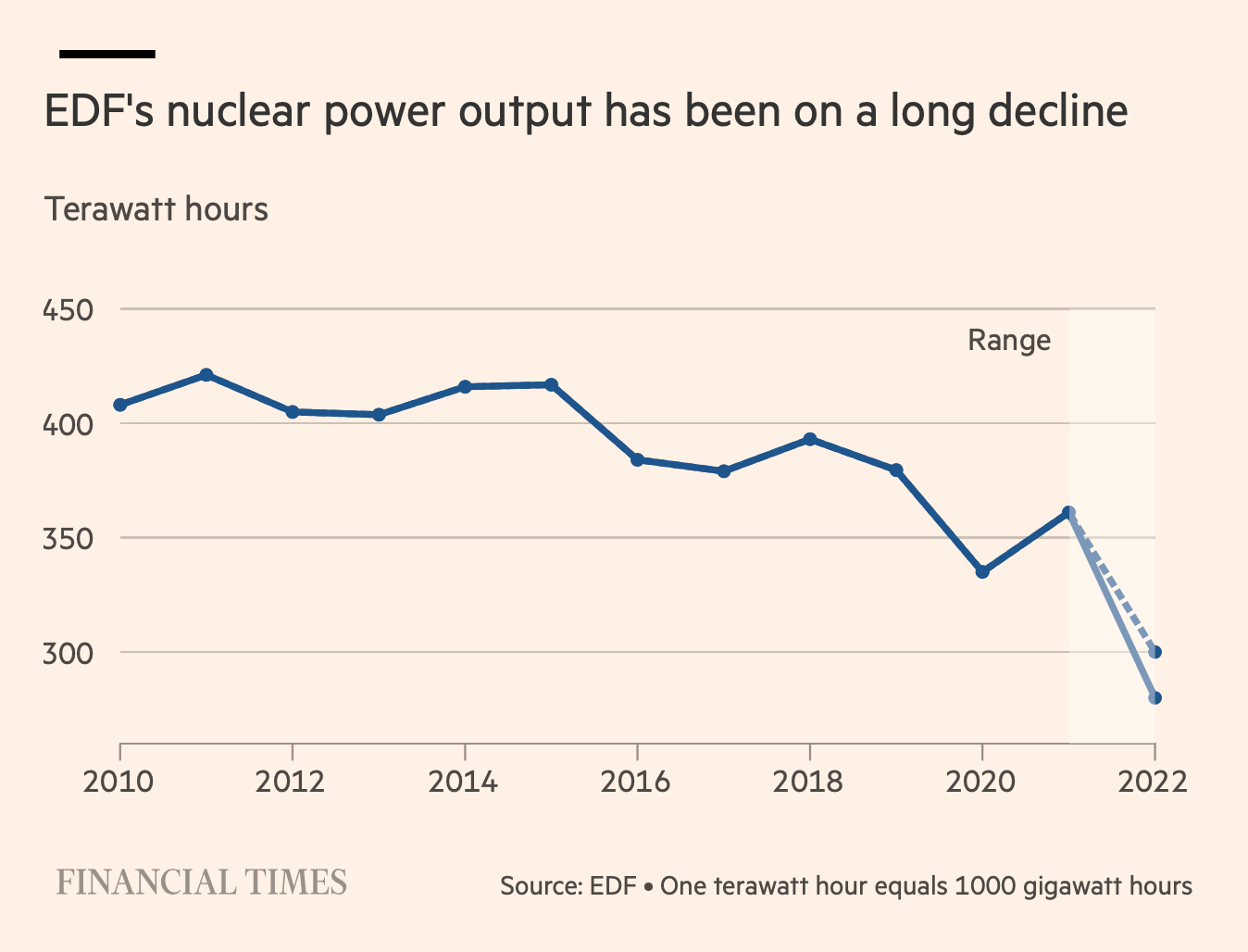

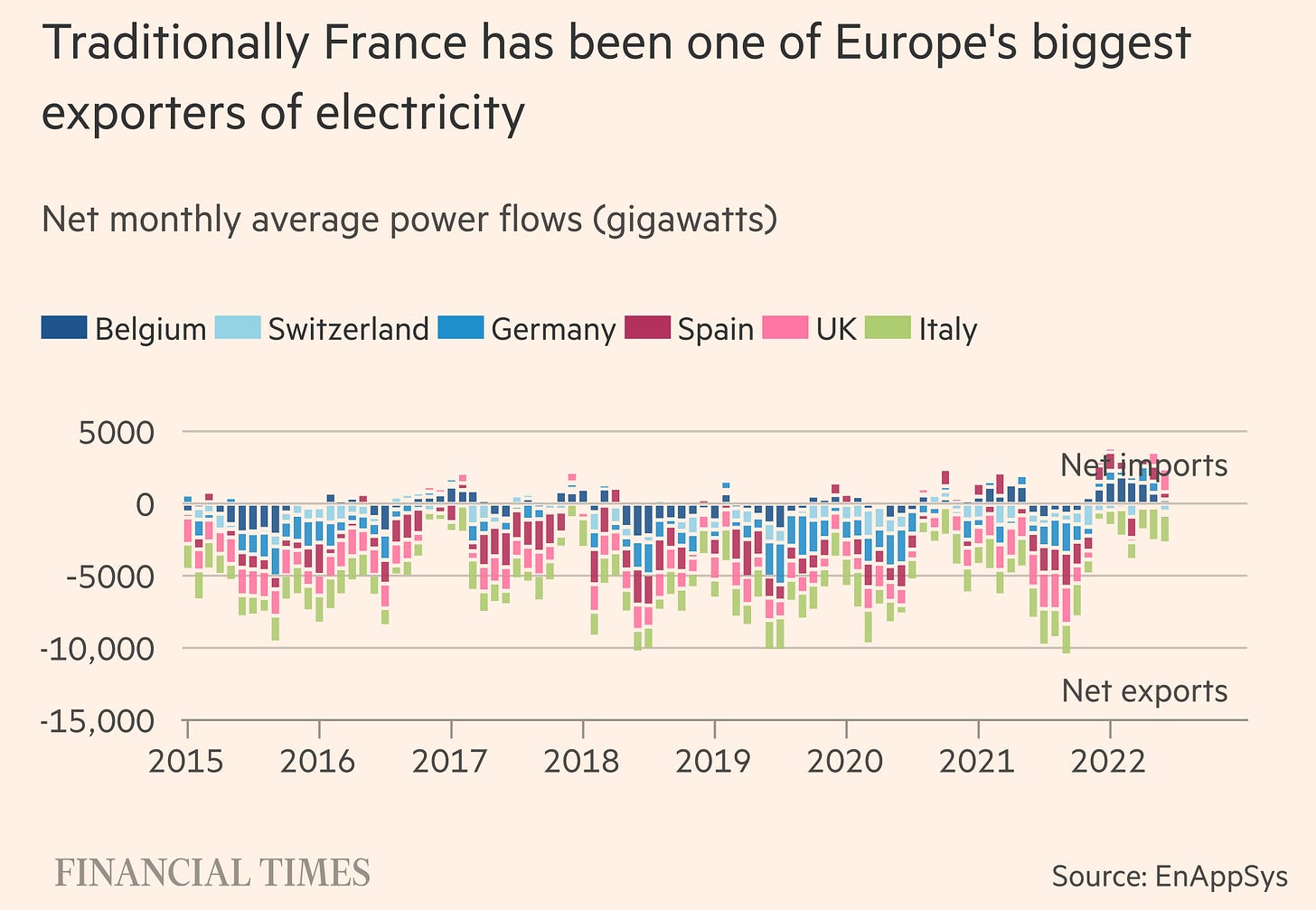

Overall supply levels. With the existing nuclear fleet getting older, it will likely require more maintenance (both scheduled and unscheduled), and become more vulnerable to loss of skills as experienced nuclear workers retire and are only partly replaced given the uncertain prospects of the sector. The large drop in generation levels in 2022 is linked to the specific corrosion issue that has caused unscheduled stops to multiple plants, but the trend over the last 10 years has been down. This has caused France to turn from massive exporter of electricity over the past 20+ years to importer this year. With very little new capacity under construction (whether nuclear, renewables or other), it is hard to see what can change this trend. Roughly 2 GW of relatively-high-capacity-factor offshore wind will come online in the next 2 years, but beyond that the pipeline is quite empty (and the lower capacity factors of onshore wind and solar mean that the current pipeline in these sectors is not sufficient to provide a lot of additional generation in the next few years). Macron announced in early 2022 the decision to build 6 new EPRs, but these could take 15 years or more to come online. How much can EDF’s nuclear fleet generate sustainably over the coming years? What will cover the gap?

Source: FT, Power plant shutdowns hinder France’s ‘nuclear adventure’ (17 May 2022)

Expensive imports. The lower production levels mean that EDF needs to import increasing volumes of power. With the current gas crisis triggered by the Russian invasion of Ukraine, this leads to very high power prices and significant costs. Over recent weeks, EDF has imported close to 5 GW of power on average, at prices in the 200-600 EUR/MWh, meaning a daily bill of close to EUR 50 M, ie potentially more than EUR 1 billion per month. We’ll see if both imports and prices stay at their exceptionally elevated current levels, but it is notable that futures for next year are substantially higher for France than for its neighbors, and very high at levels in the 400-500 EUR/MWh range. Can EDF afford such prices, and will it be able to pass these on to consumers (as per below)?

Source: FT, EDF’s problems pile up as full nationalisation looms, 17 July 2022

Blocked retail prices. After years of being told that France has the cheapest electricity thanks to nuclear, the price of retail electricity is a highly volatile political topic. Energy prices are a hot-button issue everywhere, but they are specifically so for President Macron (the gilets jaunes protests that marked the first half of his first presidency were largely triggered by fuel tax rises), and even more so for electricity, with EDF playing an oversized role in France, as as proud symbol of French public services, of French engineering excellence, and of the French nanny State more generally. So the government has decided to block the retail price for the majority of households, curtailing EDF revenues even as its supply costs increase. Ultimately this will have to be borne by the State, implicitly or explicitly. Most French people are both ratepayers and taxpayers, but a significant budgetary cost will have an impact on other political priorities. Who will pay for the gap?

The ARENH boondoggle. As part of the opening of the French power market pushed by the EU commission, EDF has been forced to sell a chunk of its nuclear production (initially 100 TWh/y, ie roughly 25% of its production) at a fixed price (42 EUR/MWh) to new competitors on the retail market. For a while competitors complained that the price was too high, and did not take advantage of the full volumes (as it was cheaper to buy power on the spot market), but obviously this is now highly advantageous. To help these retailers keep their prices down (and avoid bankruptcies as have happened in other countries), the government further imposed in early 2022 that EDF should increase its deliveries from 100 TWh to 120 TWh per year, (ie potentially close to half of its current production), forcing EDF to buy the corresponding volumes on the spot market at full price, causing it further losses. This is of course quite controversial as it means bailing our private sector players with EDF’s money (and was one of the reasons behind the decision to nationalise EDF), but the government seems to think it’s a price worth paying in the short term to avoid the political consequences of large increases in electricity prices. The medium term sustainability of such a decision is however open. Will the government try to get rid of the ARENH mechanism (and open another front with the EU Commission)?

EDF restructuring and EU competition issues. Several of the items above remind us that EDF is a topic closely watched in Brussels. The earlier EDF restructuring concept (codename “Hercule”) which proposed to split EDF in 2 entities (nuclear and hydro, publicly owned: networks and renewables, to be listed) was opposed by unions, and viewed with skepticism in Brussels. The notion that France is trying to limit competition in the French power market to protect EDF makes Brussels inherently suspicious (although the situation following the war in Ukraine may ensure that France’s longstanding arguments involving security of supply are taken more seriously and not just as a protectionist ploy). Beyond EDF’s nationalization, the price caps and the ARENH mechanism keeping competitors afloat at EDF’s expense ensure that the market landscape is already absurdly distorted. The arguments against electricity spot markets being driven by gas (why have a high price for electricity when most of the supply is coming from low cost generators) will be difficult to make if France needs to import power from neighbors - who are stretched as well: only market-driven (and likely high) prices will generate the incentive for them to sell to France. At some point the French government will need to explain to the French public that electricity is no longer cheap… When will it face that reality?

The hydro “nugget” and associated strategic issues. One of the topics that derailed the Hercule process was what to do with EDF’s large portfolio of hydro generation. The EU commission has long wanted to open up that sector to competition and force the government to tender the dams when the concessions granted to EDF come to an end. Hydro is vital to balance the French system, and will be even more valuable in the future as renewables require to be accompanied by flexible production and/or storage, both of which hydro can provide. These assets are thus potentially highly valuable; they are also strategic (keeping them in-house at EDF hides some of the system costs of nuclear; they are also seen as highly symbolic by EDF’s powerful unions and represent “national wealth” that should not be privatized). There is genuine strategic question as to how they should be best managed - by the private sector to promise revenue within the existing market design, or by the public sector, with a strategic/national view but also the risk of less economic discipline. The answer is by no means obvious. EDF had a good track record, as a national company, of managing the power system efficiently, quite cheaply and in the national interest; it has not fared so well as a semi-private company under the conflicting forces of competition, market discipline and (often short term) French government interventionism. It will continue to be submitted to these conflicting forces, but, for the first time, it will face that at a time when its generation capacity is insufficient rather than oversized, and its investment - and thus external financing - needs are massive. What influence will prevail - competition or short term political bias?

Ignorance. That leads us to the last issue that EDF faces, and in many ways the biggest. France, its political class and its population, has lived in a blissful world where the country’s electricity was both cheap and decarbonated. It has nothing but contempt for attempts by others, in particular Germany, to transform their power sector with renewables, mocking them for high prices, still-high carbon emissions, dependency on fossil fuel imports, dismissing renewables at unreliable and expensive, and seizing on any temporary upward blip on the downward trend in coal consumption as proof of the failure of the Energiewende. The decision to close nuclear plants is seen as the height of folly - and hypocrisy. That discourse (which can also be heard in the English language press, with more emphasis on the supposed cost angle and, more recently, the Russian dependence aspect) has been heard at every level of society and means that the country is not ready to discuss any solution outside of nuclear. The notion that its existing nuclear plants are getting dangerously old and unreliable is largely ignored, and the fact that EDF has proven unable to build the next-generation EPRs is either seen as a temporary blip, or a plot by outsiders to weaken the country (anti-nuclear policies, pushed in particular by Germany, are seen to have willfully weakened France’s industrial base). Renewables, despite all evidence to the contrary, are still seen as either a useless greenwashing sideshow or a dangerous distraction. That makes it almost impossible to have a serious conversation about what to do next. So: will France realize it has a severe - maybe existential - crisis on its hands with EDF? And will it choose a different path than the nothing-but-nuclear route of the past? And if not, what will happen?

Why is EDF involved in military business? Any idea? They appear here in an exemple for section 8.1.

For EDF: The uses of AI in military environments could include: decision and planning support, collaborative combat, cybersecurity and digital influence, logistics and operational, robotics and autonomy, support services and target identification and engaging.

https://ec.europa.eu/info/funding-tenders/opportunities/docs/2021-2027/common/guidance/how-to-complete-your-ethics-self-assessment_en.pdf

Hi Jérôme, I'd like to use your analysis for an article in qualenergia.it in Italy, quoting you as the source. May I do that? Let me know. Thanks, great article by the way!