The call for more nuclear power - already loud when the debate was “only” about whether NordStream 2 made sense or not - has grown significantly since the war against Ukraine has started and underlined (yet again) Europe’s dependency on Russian gas. Macron’s announcement in early February to build new nuclear power plants has been followed recently by a strong push to do the same in the UK and by the decision in Belgium to expand the life of its existing plants.

I am not anti-nuclear. I believe I wrote a pretty strong endorsement of France’s nuclear build up in the 80s (and wider energy policies at that time). And yet I will argue here that while there might - barely! - be a case to extend the life of existing nuclear plants, there is no such argument to build new nuclear plants, and I will go even further and say that such plants will certainly not be built in Europe, other than, maybe, a handful, that will be incredibly late and incredibly expensive and will widely end up being seen as the Northern equivalent of white elephants.

The arguments to say that so forcefully are the following:

Its generation profile, “baseload” (i.e. constant production at full capacity) does not actually correspond to what the market demands, and does not easily provide for flexibility, reliability or load following. The fact that our systems have been built around baseload (nuclear and lignite) has pushed us into ways of thinking that are not actually useful - baseload is not enough, and it’s not that useful

In that context, nuclear, which requires a lot of backup, will be even more incompatible with future generation sources, which will be increasingly dominated by renewable sources, irrespective of whatever else happens, as these renewables are need backup, but use it differently

Most importantly, and contrary to the situation in the past, nuclear is now a lot more expensive than the alternatives, and the trend is in the wrong direction for nuclear

A cause of the above, and a major obstacle in its own right is that nuclear power is simply not financeable - and cannot be funded other than directly on the State budget, which will prove unacceptable beyond at best a handful of units when so many cheaper alternatives to get carbon-free reliable power now exist

Baseload is not adapted to demand

Nuclear is often presented as reliable and a necessary backup to renewables (it runs when there is no wind and no sun…). But this is, quite simply, incorrect. Nuclear is baseload, i.e. it runs all the time, which means that it is at heart not designed to have flexibility. Just like renewables, its cost structure is largely fixed: large investment upfront, amortised over many years, low operation costs afterwards. Any deviation from maximum possible production leads to operational inefficiencies and a higher cost per unit.

At the individual plant level, it is possible to bring production down, and adapt to demand in that direction (something which is also possible for wind farms, of course, at a lower technical cost, when wind blows) but that does not reduce the plant’s costs and has a direct impact on unit costs. This will typically not be the cheapest way to reduce supply.

At the system level – and this is what France has learnt to do, given that it had, for a long while, excess capacity – it is possible to have upwards flexibility by running plants below nominal capacity and increasing their production when required. Again, this has an immediate impact on unit cost (any MWh not produced does not reduce the spending on the plant, and thus increases the cost allocated to the smaller volume MWh actually produced). The French nuclear fleet has been running at an average capacity of 70–75% in the 2000s (before the technical issues in the last two years) – compared to a “normal” capacity factor of 95% or more for an efficiently-run nuclear plants: this means that the cost per MWh is structurally increased by 25–30%. In addition, while EDF has learnt to do quite a few things with its nuclear fleet, upwards flexibility, especially in the short term, is better managed by other plants, usually hydro or gas–fired plants.

And such upwards flexibility is only possible at times of low demand – when demand is high, it is logical that the nuclear fleet will be at full power, and thus cannot respond to further demand increases. Wind farms can also be used below their nominal capacity, to have some reserve capacity when there is wind, but that is not conceptually different than a nuclear fleet that has a fixed maximum capacity which is not used in full.

In any case, it makes little sense to keep nuclear in reserve to start it just when there is no wind – it does not happen that often, and is not a good use of a plant that’s very expensive to build and should run as much as possible.

But in any case, and most importantly, demand is not flat. It typically varies from 1 to 1.5 between night and day, 1 to 2 within a week, and 1 to 3 over the year.

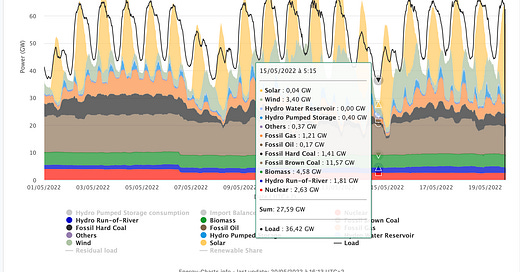

Source: Frauhofer Institute, Energy Charts

To give a recent example, German demand was 36 GW on 15 May (Sunday) morning and 66 GW on 16 May (Monday) noon. Baseload does not correspond to demand at all, and baseload production like nuclear (and lignite) needs in any case to be complemented by flexible production capacity that is turned on only when demand required is – typically each day during the daytime peak(s). This is provided by hydro or fossil–fuel plants (gas or hard coal). In the above example, in Germany, at both times, baseload production (nuclear + lignite + biomass + run–of–the–river hydro) was 20 GW.

In France, excess nuclear (in particular at night) has been exported - cheaply - to neighbors, while periods of high demand (in particular peak day-time demand) led to temporary - and expensive - imports from the same neighbors. Even if France’s net trade balance was strongly positive, thanks to structural exports to the UK and Italy, the gross volumes traded on a daily basis can be quite larger than the net volume, and we tend to forget that France’s over-sized baselaod capacity was manageable thanks to Europe’s very large available storage/flexibility capacity in the form of the Alps’s large hydro capacity, both in France and in neighboring countries.

We’ve grown so used to having that backup capacity focused on complementing inflexible baseload that we tend to forget that it can also be used to complement other less flexible sources like renewables.

What is certainly true is that backup for wind+solar requires more MW (capacity) available from other sources: at the graph shows, at the time of low demand mentioned above, there was neither solar nor wind – and there still was very little wind at the time of the next day’s peak (but there was a lot of solar). But two things are not obvious: (i) that complementing wind+solar requires more MWh (energy) from flexible sources, and (ii) that providing more MW is actually expensive.

The first question depends a lot on what needs to be complemented, obviously. Given the lower average capacity factor of wind and solar, it is likely that we will end up with a surplus of renewable capacity, and times when production exceeds demand. At such times, production will need to be curtailed (or exported, or stored, or used in new ways) – but it means that the gap will also be smaller the rest of the time. For baseload, the same question applies – if capacity is limited to the lowest demand, the required complement is higher; if capacity is higher than minimal demand (as France chose to do), there are needs for regular exports (typically, at night) but also smaller needs for complementary production.

(I have been trying to build graphs showing some scenarios of [demand - nuclear] and [demand - renewables] using real data from periods with both very high and very low renewables penetration, and longer averages, to show the point above, but I have failed at that for the time being and this has delayed this article, so I’m posting this now and will revisit this specific point again later)

It is striking to note that in Germany, where baseload production from nuclear and lignite is down significantly (from 300 TWh/y 20 years ago to half that in recent years), and renewables are up by 200 TWh/y in the same period, the requirement for flexible electricity (gas + hard coal) has actually gone down in the same period.

A likely conclusion is that potential flexible needs for largely renewables systems are not significantly larger than what was needed with nuclear plants, in terms of energy production, and thus emissions – and that's before we learn to adapt to the new production profiles, just like we learnt to adapt to baseload production: in fact, it is reassuring to see that renewables already work quite well in a system optimized for large baseload volumes.

It also shows that adding any volume of nuclear in a system where renewables are already plentiful is not very efficient: there already are periods of surplus production, where the additional nuclear production will be completely wasted, and there will be more periods when curtailment is needed. As the growth of renewables capacity can be considered a certainty, that has to colour any decision to invest in new nuclear.

The second question (the cost of spare MW) has two answers. One is that the necessary capacity exists, today, and there is a known business model for that capacity to be used profitably under current market designs focused on spor prices, that for “peakers”. The second is whether that capacity can be maintained and expanded in the future. That will require new construction, which could be a challenge. This will depend on the market design that will be applied – a pure marginal price spot market could do the trick, if high peaks are tolerated (a big if), or a capacity market where such plants are paid fees to be available, and produce only upon demand from the grid. The good news in any case is that (i) we know how to build and operate such plants and to design rules to get them built, (ii) the cost per MW of flexible capacity is low, and (iii) this does not even consider how the grid will evolve, in particular on the demand side – if we have a lot more storage (and remember that a lot of Europe’s big hydro is currently used as a huge short term battery to smooth out the daily gap between flat nuclear and variable daily demand, storing at night, and releasing during daytime), interruptible demand, smart grids, the size of the eventual problem will be much smaller. Twenty years ago, grid operators were genuinely doubtful that they could absorb 20% of renewables on an ongoing basis. Today several countries are at 40% on average (with much higher peaks), and grid operaotrs are wondering how to do 80% or more, and seem increasingly confident that they will get there. It’s to a trivial question, but it’s not an impossible one, and it does not seem to be an expensive one - if anything the biggest obstacle, like on the generation side, seems to be on the permitting side for new infrastructure, which is subject to bottlenecks and endless legal recourse.

In any case, this means that nuclear is not obviously better than renewables as regards adaptation to demand, and in a system with lots of renewables (a certainty), nuclear is actually increasingly hard to integrate.

Nuclear is a lot more expensive than the alternatives available today

The second argument is even more damning for nuclear.

As a starting point: it is undoubtedly true that industrial-scale nuclear power, as built in advanced Western countries in the 1970s-1990s, has provided, and still provides, cheap power, even taking into account the uncertainty on the cost of both long term waste storage and dismantling of the plants. And, until recently, low carbon alternatives like wind and solar were between “somewhat” and “a lot” more expensive. To a large extent, French skepticism about renewables over the past 20 years was not unreasonable given that the country did not have carbon-spewing (and otherwise polluting) coal-fired plants to replace - it had and has a low-carbon and cost competitive power sector.

But the long term trends have been up for the cost of nuclear, and down for the cost of renewables, to such an extent that the situation has now almost fully reversed.

In the past 7 years, offshore wind has gone from >150 EUR/MWh to <50 EUR/MWh - under competitive tenders that see projects being completed within a couple of years of tariff allocation. Solar tenders are regularly won at lower prices, often below 25 EUR/MWh.

Source: Lazard’s Levelised Cost of Electricity Analysis Version14.0, October 2020

As to nuclear, it is hard to come up with reliable numbers. Bullish governmental studies have suggested numbers from 60 GBP/MWh to 40–60 EUR/MWh. The Lazard LCOE study above proposes somewhat higher numbers – but maybe more importantly that the absolute numbers, which can be endlessly discussed, is the trend, which shows steadily increasing numbers for nuclear (and steadily decreasing ones for wind).

What is possibly the best estimate of the cost of generation of new-build nukes is the tariff negotiated by EDF with the British government for Hinckley Point, the nuclear plant now under construction in the UK, being 92.5 GBP/MWh, inflated, over 35 years, as that reflects the bet made by a (semi-)private company that it can build the plant and operate it at a profit with that price (whether it will be profitable for EDF is another thing, and the latest news of yet more cost increases put that further in doubt – but at least with the current contractual mechanism cost overruns are borne by EDF and not by UK ratepayers). What we can say is that we still don’t know the cost of MWh that will eventually come out of the Flamanville EPR in France. The original budget was EUR 3.4 bn for a production start in 2012 but construction has been subject to multi-year delays (expected operation date is now not before 2023 and still rather likely to be beyond that) and an increase of the cost to EUR 19.2 bn, (five times more) as per the latest assessment by la Cour des Comptes (the French State auditor). And nobody knows the price of the MWh from future, yet-to-be-approved new plants.

Today, it is not even obvious that extending the life of existing plants is a good idea, cost-wise. In 2016, EDF indicated that the cost of the “grand carénage” (the plan to upgrade and extend existing plants) would lead to a cost of electricity of 55 EUR/MWh. Since then, cost estimates have varied only marginally from their starting point, suggesting a cost of electricity from life extension in the, at best, 50-60 EUR/MWh range. In the meantime, it bid to build the Dunkirk offshore wind farm with a tariff of 44 EUR/MWh over 20 years, even if it is rather shy about that bid - it is impossible to find the tariff they bid on the website of the project…) In other words, EDF itself believes it can get power cheaper from new offshore wind than from the refurbishment of its own nuclear plants.

There are a number of reasons as to why nuclear is more expensive - part of it is certainly due to increased safety requirements following the accidents in Chernobyl and Fukushima (whether it’s “gold-plating” or not), and some may be linked to the loss of knowledge and know-how after a long period where very few nuclear plants have been built in the West. But the main reason is that it is almost impossible to raise cheap finance in the form of project-specific debt or equity for nuclear projects without State guarantees. In the absence of massive State support, projects need to be financed by utilities at their weighted cost of capital - which itself will be unfavorably increased by the need to commit the massive amounts required for each power plant - and they still require explicit or implicit State guarantees as regards major accidents and waste disposal. For a capital–intensive generator, the cost of capital is vital to the long term cost of electricity, and the impossibility to bring in - either during construction or later - cheaper capital, means that capital will always be a lot more expensive than, say, for offshore wind.

Source: Lazard’s Levelised Cost of Electricity Analysis Version14.0, October 2020

Again, the Lazard study gives an idea of the impact of the cost of capital, with the cost of electricity from nuclear almost doubling between the best and worst cases, as opposed to an increase by a third for onshore wind (also capital intensive, but with a short construction period) and to less than 20% for gas–plants that are less capital intensive. Even gas peakers, which are designed to produce very little, and are thus a lot more capital intensive than other gas plants, are still less sensitive to cost of capital than nuclear plants.

In fact, this was one of the most controversial assumptions in the report by RTE (the French grid operator on future “net zero” scenarios for France. It concluded that renewables were indispensable, and it was possible to get to net-zero without any nuclear, but also noted that scenarios with some nuclear would be slightly cheaper than scenarios with more renewables – but it reached that result by using the same WACC of 7% for nuclear and wind, which is patently unrealistic, and has a material impact, which they acknowledge themselves.[1] The actual current WACC of wind is, conservatively, 2% (projects typically attract 90% of debt, at a fixed interest rate of 1% over 20 years, and 10% of equity, with an IRR expectation of 5%). The current WACC of EDF is probably somewhere in the 4–5% range, with its long terms bonds yielding around 2% and equity coming from the public markets.

The likely reorganization of EDF to allow it to deal with nuclear – the extension and then dismantling of current plants, the management of waste and the proposed construction of new plants – is a hot political topic, and the latest attempt to split the company to manage that (effectively by nationalising the nuclear part) was abandoned last year. It is likely to come back, and it seems inevitable that there will be more rather than less State involvement in the nuclear part of EDF’s business, especially as the company now grapples with unprecedented stoppages of existing plants due to corrosion issues. But unless there is full State–backing for all construction costs, and a full exemption from EU State Aid rules, the cost of capital for the “nuclear EDF” will not be lower than the current number, meaning that nuclear will be a lot more expensive than renewables which can be built with very cheap and plentiful private capital. And the expected increase in long term interest rates will impact nuclear and renewables similarly, so there will be no differentiation there.

In short, nuclear is structurally more expensive to finance, and thus structurally more expensive.

Altogether, nuclear is increasingly unwelcome in our grid as it evolves to adapt to the increasing and unavoidable penetration of renewables, it is definitely more expensive that renewables as regards new plants and probably also as regards the life-extension of the existing ones, and it cannot easily be financed. A few governments will undoubtedly pursue, at great cost, the construction of new plants beyond those already under way like Hinckley Point and Flamanville, despite their troubled and still uncertain path to operation, but will not be able to afford more than a handful.

And in any case, these plants are exceedingly unlikely to be in operation before 2035, by which time they will be obviously unneeded, as the irresistible march of cheap renewables makes the question moot.

[1] The RTE executive summary specifically states that “Des conditions de financement défavorables résultant par exemple d’une absence de soutien public ou un accès plus difficile à des financements européens seraient de nature à augmenter le coût complet de la production nucléaire, avec un effet qui se répercute- rait sur le coût total du système électrique. Dans le cas où cette différence porterait sur trois pourcents de coût du capital, le coût d’un scénario comprenant de nouveaux réacteurs serait équivalent à celui du scénario «100% renouvelables» présentant le meil- leur bilan économique, c’est-à-dire celui fondé sur de grands parcs (M23). »

« Unfavorable financing terms (for instance in the absence of public support or more difficult access to European funding programmes) would lead to an increase of the total cost of nuclear power production, and to a higher total system cost [in such scenarios]. A 3% difference on the cost of capital would lead to the cost of the scenario with new nuclear plants to increase to the same level as the cheapest “100% renewables” scenario, being the ‘M23’ scenario which emphasises large wind farms. »

Excellent article, as always, which would deserve to be circulated broadly to our French politicians. Note that 92.5 GBP/MWh paid for Inkley Point nuclear is in 2012 price, so more than 120 GBP/MWh in today's price, close to 150 EUR/MWh...

Except all wind turbine components as well as solar components are made in China. The gas & coal comes from Russia. What is the cost of dependence to foreign authoritarian regimes ?