The past year has seen both a terrible political backlash against renewables (and climate policies more generally) and a relentlessly negative mood music about the sector, making it sound like nobody is investing in the sector, even though the industry keeps on breaking records.

It’s been difficult to write anything mildly positive or just sensible about activity in the sector when it risks simply being drowned out by these negative perceptions and ignored.

The negative context has been driven by headlines focused on the offshore wind sector (some projects abandoned or delayed in the US, the UK “round 5” auction getting no bidders) and generated by high profile decisions, mostly by oil&gas players, to reduce their exposure to the sector and do so rather noisily. This has naturally been seized upon with glee, and amplified, by opponents to the sector, who remain active, if slightly more subtle than in the past.

It has had some really effects, in particular in my small corner of the market (early development for offshore wind, in particular floating offshore wind), where investors have become a lot more prudent and mostly adopted a ”wait and see” attitude to new projects and markets rather than the enthusiastic “must have” rush of a few years ago.

So, just last week, you could still read headlines like “European utilities cut renewable targets as high costs and low power prices bite” that make it sound like investment is really slowing down… when it really isn’t, and prices are getting worse, when they aren’t…

So what explains the discrepancy?

At some point people should realize that (i) investments have continued, (ii) the price increases that hit the sector have hit other sectors as well so do not really hurt its relative competitiveness, and (iii) it works…

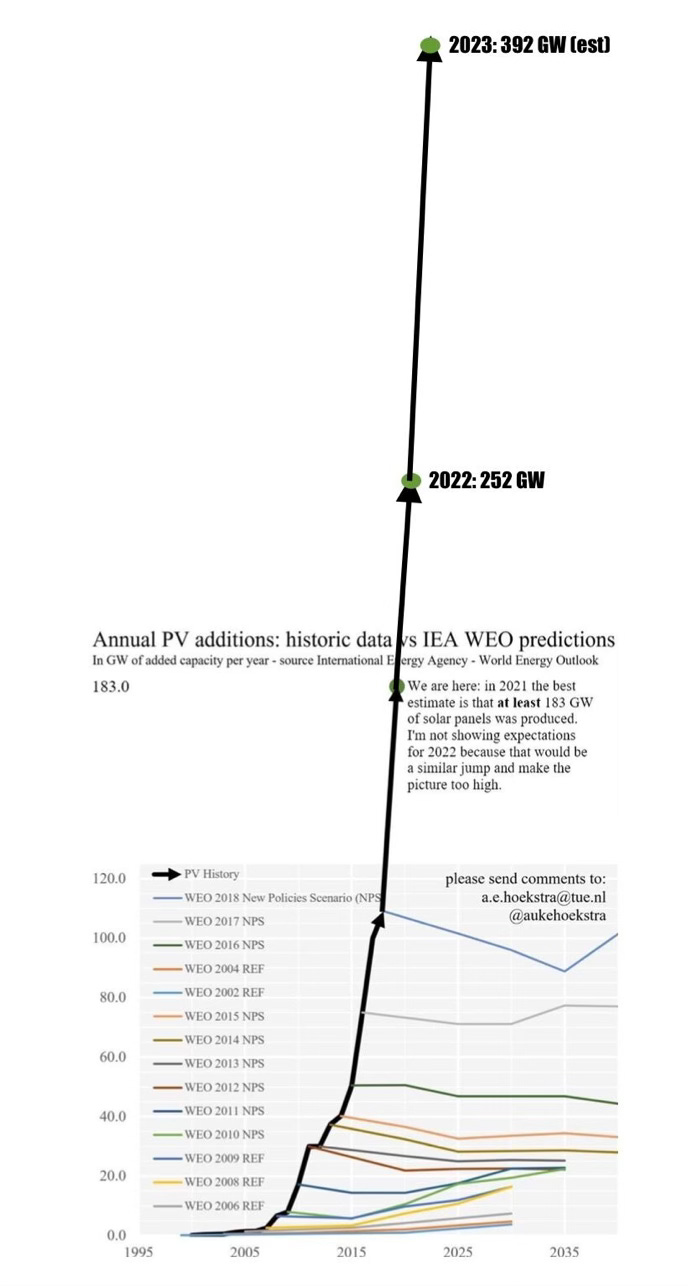

Source - somewhere on LinkedIn, attributed to Auke Hoekstra

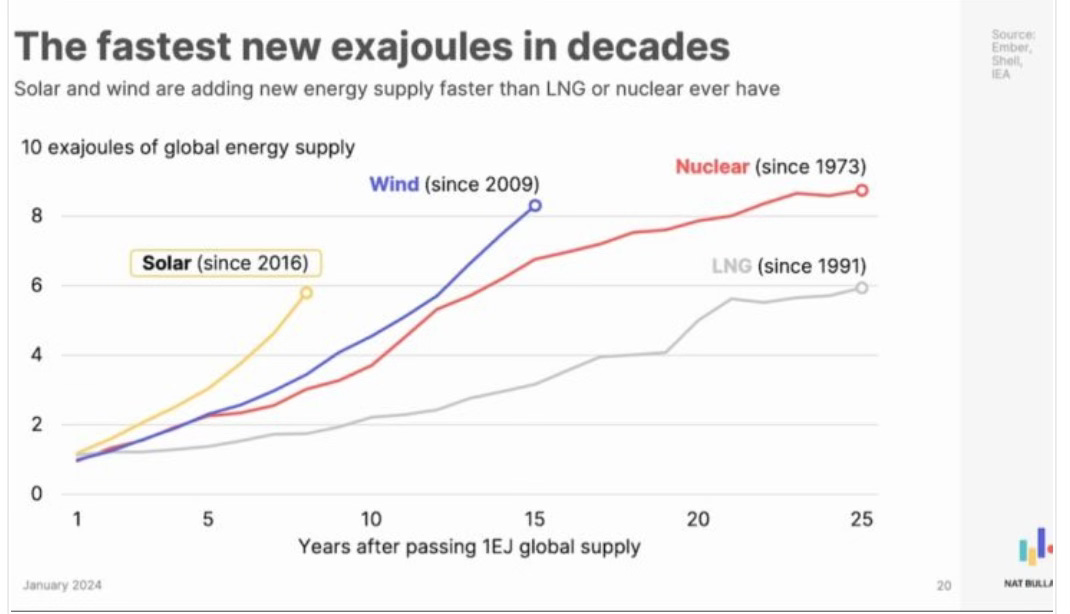

Source: Nat Bullard - Decarbonization

I’ve been thinking that it may just take a couple of eye-catching announcements (a new tender at lower than expected prices, a new high profile acquisition) to change the mood and suddenly switch everybody from “let’s wait” to “we need to do this” but I’m not so sure - we’ve had such announcements already (recent news about the tenders in France, Norway or Australia, for instance, or proposed acquisitions like OX2 by EQT) and they have been largely ignored outside of the industry.

But that last FT headline made me realize why - these positive stories did not come from the big players (oil&gas majors or the key publicly-traded utilities) and they are not, how shall we say, very click-bait-y… Complex stories, unknown parties, and it doesn’t bleed… Not headline material.

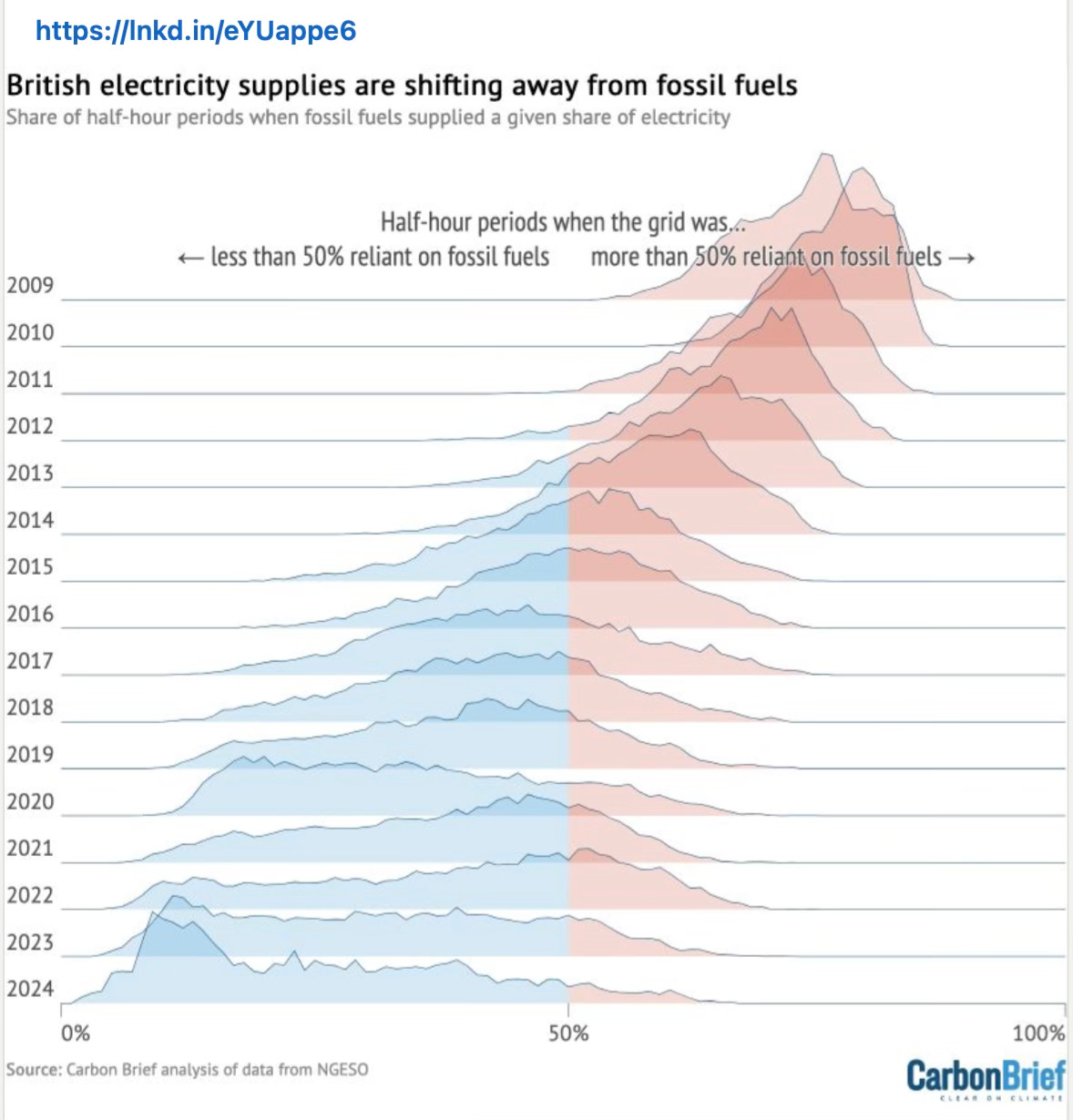

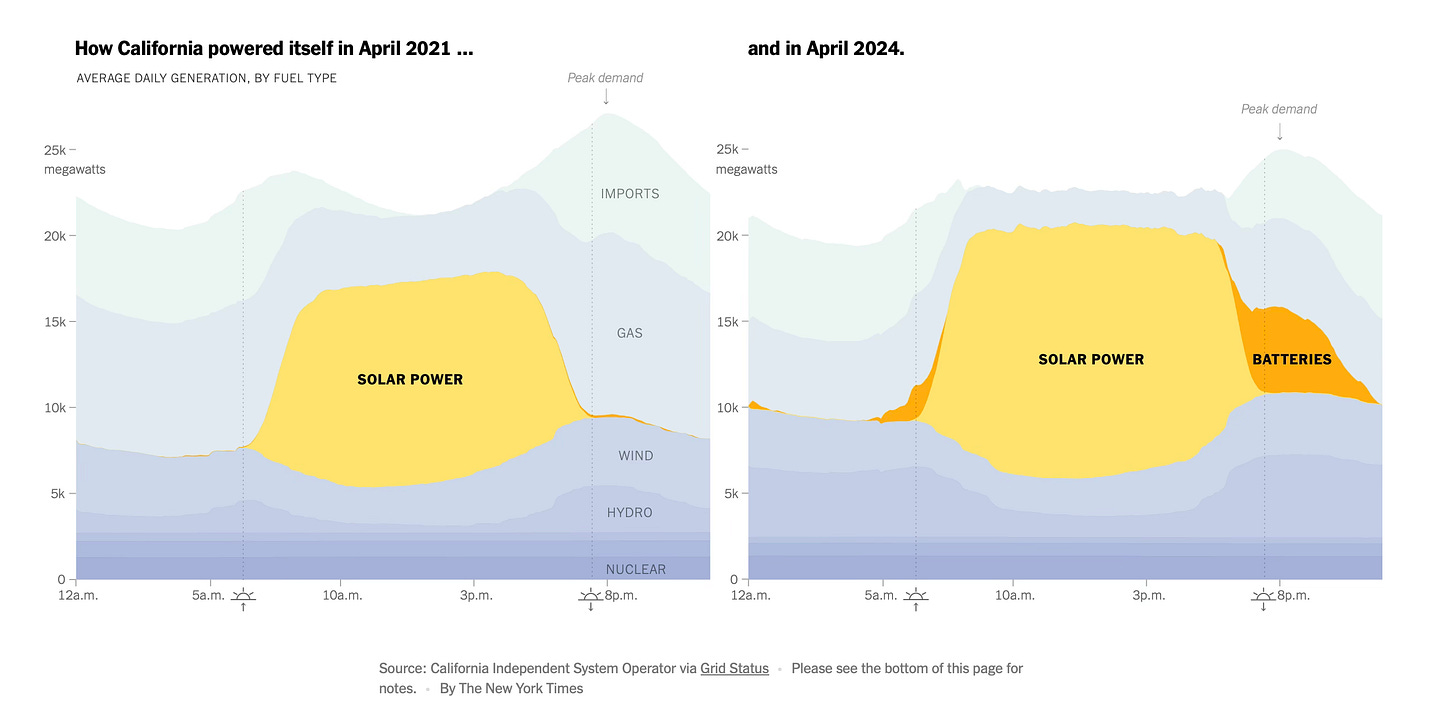

To me, the main story this year is actually that we are beginning to see our power systems completely taken over by renewables. In places like the UK (see above), California, Spain, and even Texas, or Germany, solar is now dominant for many hours each day. Even more interestingly, the availability of battery storage solutions is now extending the period of carbon-free, or at least carbon-light, electricity by several hours each day (and the growth of batteries is even more explosive than that of solar).

Source: NYT “Giant Batteries Are Transforming the Way the U.S. Uses Electricity”

This is naturally happening first (i) in the places that have built quite a bit of solar, (ii) that have the relevant sunny climate, (iii) during the warmer season, and (iv) during the day. But the growth in solar penetration has been phenomenal in a lot of places, and such dominance of solar is soon going to extend from a few hours per day a few weeks per year in a handful of countries to most of the day (and night), a large fraction of the year, in a growing number of systems. At some point - and this is likely just a few years away, we’ll likely have to manage increasingly often the situation where there is more electricity available than demand, and prices crash to zero (or below). I’m actually not too worried about this “problem” - we are talking about having a really useful input (energy, in a highly usable form) available at a low price: I’m sure lots of ways, old and new, will be found to make use of that resource and turn it into something valuable in monetary terms when it’s in surplus… Storage is the most obvious one, but I’m sure there will lots of interruptible activities that will grow to take advantage of low prices with high flexibility.

But the consciousness of this is not percolating yet. There’s two reasons for that: (i) the system is not crashing, so journalists have no acute reason to talk about it (you’ll note that articles usually come when some production or penetration record is broken) and the transition is not that visible - or only to specialized professionals and geeks, and (ii) this is happening in a completely decentralized way - there is no “solar super-major”, or even headlines-worthy multi-billion mega-projects that politicians would want to brag about or the press or stock analysts could follow.

Which brings me back to the utilities and oil&gas majors. They are in fact playing an incredibly small role in the transition.

We are used to these mammoth companies that control everything - big power plants, large customer base, massive political influence and corresponding headlines, and they are largely absent from the new system. Oh sure, they have renewables arms that are quite large, which may even be the largest around in their country or area of activity, but they make up only a small part of the overall renewable generation. (It’s a bit hard to find data, but this WoodMacKenzie report from 2019 noted that the top 10 owners of solar plants only controlled 6.9% of worldwide installed capacity, while a Finergreen ranking from 2017 showed that in France, EDF was the market leader with just 4% of solar capacity).

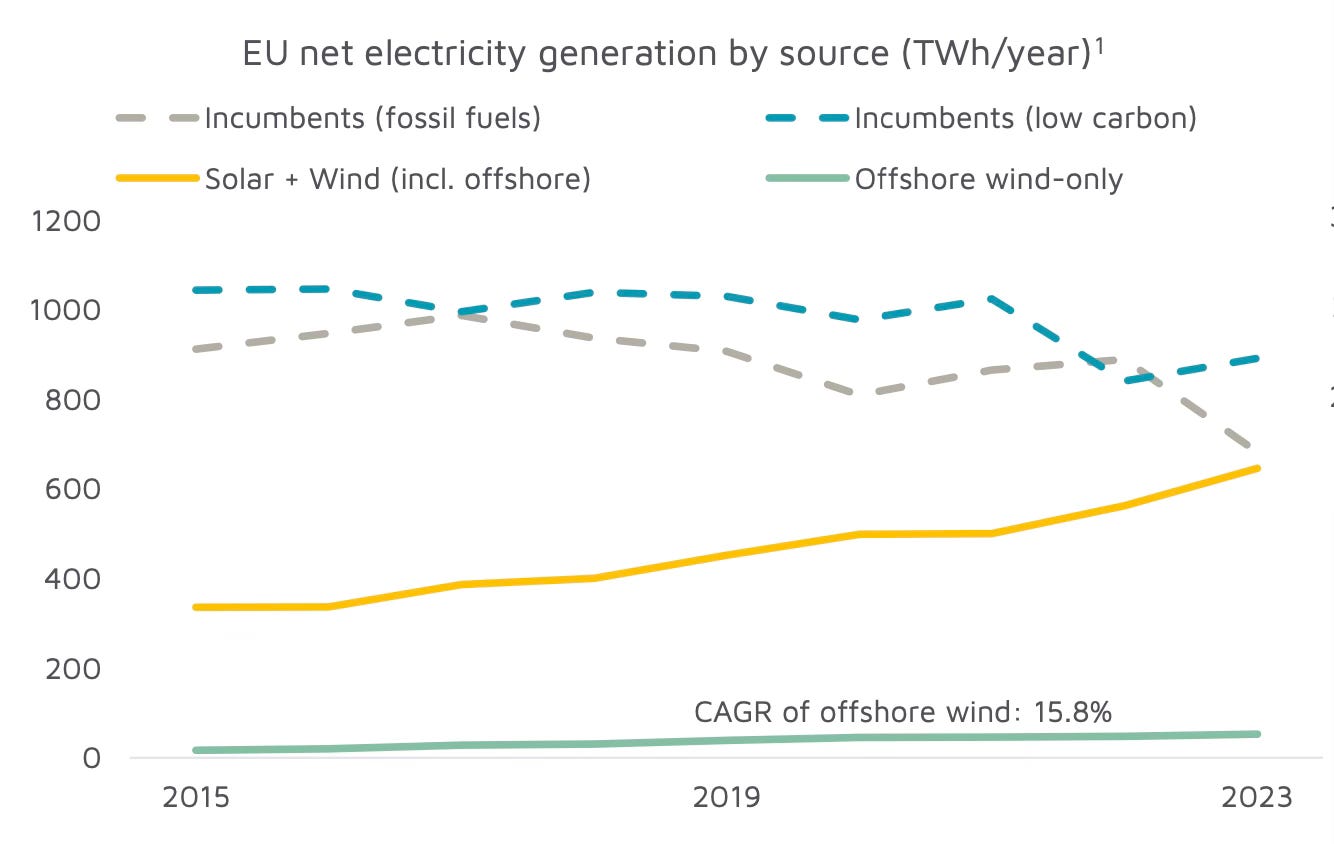

So people actually like to talk about offshore wind, because it’s understandable - big multi-billion euro investments, giga-watt scale projects, large companies developing them - but offshore wind is actually a very small chunk of the energy transition, and will likely stay that way (however much I care about the sector myself!) even in Europe…

Source: Fraunhofer ISE Energy Charts (2023), adapted by author

And even in offshore wind, the utilities are not that dominant, when competition is allowed. The recent Norwegian auction was won by parkwind and INGKA, the French one by Bay.Wa and elicio, the largest financings last year were managed by Northland Power, the biggest floating wind pipeline is probably owned by Bluefloat - all names familiar to industry players but probably not to the wider public (and not to the journalists in the mainstream business press, apparently, as they keep asking the likes of Shell, Ørsted or Iberdrola for their opinion)…

In other words, we are moving from a very centralized system, dominated by large fossil fuel plants (or big hydro and nukes where available), where supply had to adapt to demand, to a highly decentralized one, where demand will adapt to the increased availability of supply at times, in an increasingly diverse number of ways, and we’ll likely have substantial oversupply during the day - until new demand balances it out.

The grid will become used in very different ways - that transformation has been successfully happening in (relative) silence over the past 25 years and will continue.

What also seems likely is that there could be very little room in such a system for baseload production, which will need to deal with very low prices during the growing periods of solar surplus, and may soon not be needed even at night for large parts of the year - you don’t run “must run” plants 25% of the time. There is some level of constant demand from industry and a few vital other sectors, but it seems increasingly unlikely that large centralized plants will be more competitive over the year than a combination of renewables (dominated by solar), storage and some very little used flexible fossil fuel peaker plant capacity.

So, for power generation and the wider energy transition, unexpectedly maybe, small is and will be beautiful, even as the overall volumes are gigantic. For renewables, no headlines is probably a good thing (as most stories seem to be scary ones). And for offshore wind, a lack of “animal spirits” may be a pity, but the sector will remain a niche (very useful in some places) and a relative minnow compared to solar, onshore wind and, increasingly, storage.

It's also about the quiet solar successes in the Global South that no one talks about like Namibia and Chile, both of which now get more than a quarter of electricity from very cheap solar

https://prismbysugandha.substack.com/p/namibias-solar-success?utm_source=share&utm_medium=android&r=1uujiv

The graph of California in April,the month with the most ideal climatic conditions, would look very different in January.