Oscar Wilde famously wrote that people “know the price of everything and the value of nothing” suggesting there is a difference between the two concepts of price and value. In the power market, due to some of its structural features, it is even more confusing as you also need to deal with the cost of power, which may again be different.

The below, derived from an article I wrote almost 15 years ago, tries to make sense of the differences between the 3, and how these are ultimately decided by political choices.

Cost is, in principle, what the generator has to spend to produce electricity. But there is an important difference between the average cost (often knows also as LCOE, or levelized cost of electricity) and the marginal cost, which is the cost to generate an additional MWh of power at a given moment.

Price is what the generator can sell the electricity for. It’s driven by the market for power, or by the contractual terms agreed with a buyer (or “offtaker”) of electricity.

Value is, well, what the electricity provided to the consumer brings. It includes the MWh as a unit of energy that can be used to create light, heat, move things, charge a phone, etc, but it also includes externalities which are not taken into account in the price, such as pollution (if you burn dirty coal), carbon emissions (if you burn fossil fuels) or dependency on unreliable suppliers or a dwindling resource, as well as features such as timeliness (a MWh will be more valuable at different times, and is most valuable if available whenever you want it).

The link between these is not always straightforward, especially for generators like wind farms. Let’s unpack these, and see where political decisions influence the numbers.

Costs

The cost of wind is, simply enough, what you actually need to spend to generate the electricity.

Source: Leveled cost of energy (pdf) by Lazard

The graph above shows how these costs have changed over the past fifteen years for a number of technologies. For wind and solar, we see a long, slow decline as technology improved, with an an increase over the past 2 years due to inflation and supply chain disruptions, but both technologies remain the cheapest available.

(interestingly enough, my original article from 2009 had the same downward trend with an upward blip at the time of writing - somehow these price blips seem to generate a lot of angst and plentiful press articles asking whether renewables can be competitive; the steady increase in the cost of nuclear power does not seem to generate the same kind of questions)

In the case of wind, like other renewables (and nuclear) it is important to note that most of the costs are upfront, i.e. you need to spend money to manufacture and then install the wind turbines (and build the transmission line to connect to the grid, if necessary), but once this is done, there are very few other actual costs: some maintenance and some spare parts now and then.

This means that the levelised cost of wind (ie, the average cost over the long run, when initial investment costs are spread out over the useful life of the wind turbines) is going to be highly dependent on how the upfront cost is spread over the production of electricity over the life of the turbines, and that brings in a financial concept: the discount rate, or the cost of capital. That assumption about the cost of money allows to allocate a portion of the immediate cost to the MWh that will be produced in the future. Obviously, the duration over which you expect you turbine to produce electricity is an important variable too.

The discount rate will depend on whether you can raise debt (the price of which can depend on your credit rating) or need to provide equity (which is usually more expensive); altogether this means that most of the revenue generated by a wind farm at any point during its lifespan will go to repay the initial investment rather than to actual short term production costs; moving the discount rate from 5% to 10% increases levelised costs by approximately 40% (whereas for a gas project, it would typically be less than 20%).

It is worth emphasizing that "letting the markets decide" is NOT a technology-neutral choice when it comes to investment in power generation: public funding (such as can be available to State-owned or municipal utilities) is cheaper than commercial fund of investment: given that different technologies have different sensitivities to the discount rate, preferring "market" solutions will inevitably favor fuel-burning technologies, whereas public investment would tilt more towards capital-intensive technologies like wind and nuclear.

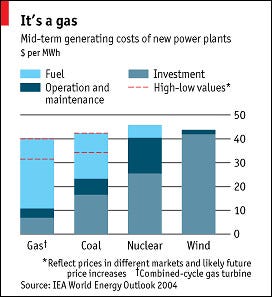

An old graph from the Economist in 2005 (I have lost the link to the original article, but like to use it because it shows that in 2004, the IEA and the Economist were already acknowledging that wind power cost about the sale as gas, coal or nuclear electricity) shows that the cost structure of different technologies is completely different: one includes mostly finance costs, the other mostly fuel costs (with nuclear closer to the economics of wind, and coal closer to the economics of gas).

Source: the Economist, 2005

Note: this reflected a price for gas at 3-4$/MBTU

As a consequence, the marginal cost of wind is essentially zero, i.e., at a given point in time, it costs you nothing to produce an extra MWh (all you need is more wind). In contrast, the marginal cost of a gas-fired plant is going to be significant, as each new kWh requires some fuel input: that marginal cost is very closely related to the price of the supply of the volume of gas needed to produce that additional MWh.

This also means that, once the investment is made, the cost of wind is essentially fixed, while that of gas-fired electricity is going to be very variable, depending on the cost of the fuel. The good news for wind is that its cost is extremely predictable; the bad news is that it's not flexible at all, and cannot adjust to electricity price variations.

Or, more precisely, wind producers take the risk that prices may be lower than their fixed cost at any given time. Given that, as a zero-marginal cost producer, the marginal cash flow is always better when producing than not, wind is fundamentally a "price-taker," i.e., the decision to produce will not depend on the price; however, the ability to repay the initial debt will depend on the level of the price, and if prices are too low for too long, the wind farm may go bankrupt.

Meanwhile, gas producers take a risk, at any time, on the relative position, of the prices of gas and of electricity (what the industry calls the "spark spread"). This is a short term risk: gas-fired plants have the technical ability to choose to not produce (subject to relatively minor technical constraints) at any given time, they can thus avoid any cash flow losses, and the very fact that they shut down will influence both the gas price (by lowering demand) and the electricity price (by reducing supply). In fact, as we'll see in a minute, electricity prices are directly driven, most of the time, by gas prices, and thus gas-fired plants are "price-makers" and thus their costs are what drive electricity prices.

This suggests, once again, that selecting market mechanisms to set electricity prices (rather than regulating them) is, again, not technology neutral: here as well, deregulated markets are structurally more favorable to fossil fuel-based generation sources than publicly regulated price environments.

At this point, the conclusions on the cost of wind power (ignoring externalities, including network and availability issues, which I discuss below) are that they seem to be close to, or lower than those of traditional power sources (nukes, gas, coal), depending on the price of fuels, but that they have a very different relationship to prices.

So let's talk about prices.

Prices

There are two aspects here: the price received by wind producers, and the price paid by buyers, which may be different.

The price of wind energy is what wind energy producers get for their production. It may, or may not, be related to the cost of the generation, but you'd expect the price to be higher than the cost, otherwise investment would not happen. But the question is, of course, whether the price needs to be higher all the time, or just on average, and if so, for what duration.

Given, as we've seen before, that wind has fixed prices, all a wind producer requires is a price which is slightly above what its long term costs are. If available, that makes investment in wind structurally profitable and actually rather safe - which means that a fairly low return on capital is required.

The problem, as we've seen, is that wind is a price-taker and, unless producers are able to find long term power purchase agreements (PPAs) with electricity consumers at a price above their long term cost of production, it is subject to the vagaries of market prices. And when your main burden is to repay your debt, and you don't have enough cash in a given period (because prices are below your cost for that period), you don’t have enough money to repay that debt and you go in default right away, even though you generate positive cashflow. That means that a bankrupt wind farm will always be a good business to take over; it's just that it may not be a good business to invest in to start with if prices are too volatile...

And thus it is not that surprising that the most effective system to support the development of wind power has been so called feed-in tariffs, FiT (or the more modern equivalent, contracts for differences, CfD) whereby the wind producers get a guaranteed, fixed price over a long duration (typically 15 to 20 years) at a level set high enough to cover costs.

The fixed price (or, in the case of a CfD, the difference to the market price) is paid either directly by the utility that's responsible for electricity distribution in the region where the wind farm is located, or by a public entity that’s created for that purpose. The utility or counterparty is allowed by the regulator to pass on the cost of that tariff (ie the difference between the fixed rate and the wholesale market price) to ratepayers. That difference may actually be negative if market prices are higher than the fixed price agreed for the wind farm, in which case the result will be to lower the cost for consumers, as we have seen in many European countries with such mechanisms in 2022.

It's simple to design, it's effective and, it's actually also a way to get cheaper electricity. Offering fixed prices to wind projects allows then to attract cheaper capital, thus reducing the discount rate which, as we noted above, is the single biggest driver of the LCOE of wind. FiTs and CfDs are like a long term interest rate swap. Nobody calls your fixed-rate mortgage a “subsidy” - as the market for long term power price swaps simply does not exist, it is smart policy to create such market by proposing CfDs - and ensuring that they reflect a real price by ensuring competitive pricing via well designed. auctions.

As wind (and renewables) penetration increase, there is another linkage between wind and electricity prices worth noting: cannibalisation.

In market environments, marginal cost rules, i.e. the price for electricity is determined, most of the time, by the most expensive producers needed at that time to fulfill demand. Demand is, apart from some industrial uses, not price sensitive in the very short term, and is largely independent from supply (people don’t worry if there will be enough production capacity in the system when they switch anything on), so supply has to adapt, and the price of the last producers that needs to be switched on will determine the price for everybody else.

Source: Economics of wind (pdf) by the European Wind Energy Association

If you look at the above graph, you see a typical 'dispatch curve', i.e. the line representing generation capacity, ranked by price. Hydro is usually the cheapest (on the left), followed by nuclear and/or coal, and then you have gas-fired plants and CHP (combined heat and power) plants, followed to the far right by peaker plants, usually gas- or oil-fired.

You take you demand curve (the quasi vertical lines you can see on the right graph), and the intersection of the two gives you the price. As is logical, night time demand is lower and requires a lower price than normal daytime prices, and even less than peak demand which requires expensive power generators to be switched on.

The righthand graph shows what happens when wind comes into the picture: as a very low marginal price generator, it is added to the dispatch curve on the left, and pushes out all other generators, to the extent is available at that time. By injecting "cheap" power into the system, it lowers prices. The impact on prices is pretty low at night, but can become significant during the day, and very high at peak times (subject, once again, to actual availability of wind at that time).

Source: Economics of wind (pdf) by the European Wind Energy Association

As the graph above suggests, the impact on price of significant wind injections is high throughout the day, and highest at times of high demand. When there's a lot of wind, you end up with prices that get flattened at the price of base load, i.e. the marginal cost of nukes or coal, or even lower.

But the consequence of this is that the more wind you have into the system, the lower the price for electricity. With gas, it's the opposite: the more gas you need, the higher the price will be (in the short term, because you need more expensive plants to be turned on; in the long run because you push the demand for gas up, and thus the price of gas, and thus of gas-burning plants, up).

In fact, if you get to a significant share of wind in a system that uses market prices, you get to a point where wind drives prices down to levels where wind power (and every other power generator) loses money all the time! As I discussed in an earlier article, this is actually becoming more visible for solar - given its regular production profile during day time, prices in the summer afternoons can become nil or negative in more and more places - and that trend will only continue.

There are two lessons here:

wind power has a strongly positive effect for consumers, by driving prices down for them when it’s available

it is difficult for wind power generators to make money under market mechanisms unless wind penetration remains very low; this means that if wind is seen as a desirable, ways need to be found to ensure that the revenues that wind generators actually get for electricity are not driven by the market prices that they make possible.

The first item above is the real reason utilities hate renewables - they bring revenues down for everybody on the generation side. Even 15-20 years ago, when wind and solar were receiving subsidized prices, the extra cost of that was not paid by consumers, but by other generators, through lower prices for their traditional plants. That led utilities to spew all sorts of anti-renewables propaganda, which still thrives to this day, even as most utilities, at least in Europe, have fully embraced renewables…

So we get an glimpse of the fact that there is value in wind power for consumers which is not reflected directly through electricity prices, and is only remotely related to the actual cost of wind.

Value / externalities

Which brings us to our third concept, the "value" of wind power, which has to include the other impacts of wind onto the system that are not captured by monetary mechanisms. This is also what economists call externalities, i.e. the impact of economic behavior or decisions which are not reflected in the costs or prices of the economic entity taking the decision. Pollution is a typical externality, but so is the impact on the grid of managing new categories of producers while ensuring system stability.

Regulation is meant to put a price on these items, in order to reflect the "true cost" of a given economic action, i.e. in this case a decision to invest in a wind farm or a gas-fired plant or otherwise. Amongst the externalities we need to discuss here are the intermittency of wind, carbon emissions (which is an existing, improperly priced, externality of existing technologies which wind can help to avoid), and security of supply.

Intermittency and balancing costs

A traditional argument against wind (its availability is variable, and cannot be counted upon to fulfill demand), which people may be surprised to find listed here as an externality - but that's what it is.

In a market, you are not obliged to sell; the fact that the electricity grid requires demand to be provided at all times is a separate service, which is not the same thing as supplying electricity - it's continuity of supply.

But while wind is criticized for its intermittency, people seem to forget that many other power plants require backup, of different kinds. Base load plants have a fixed capacity and cannot provide for demand at times of peak - that is provided by flexible, variable capacity that produces electricity only part of the time. So base load also needs “backup” in times of high demand. Large power plants like coal or nuclear plants also require the system to have spare capacity in case such plants dropped off - whether a problem (however innocuous) at the plant, or on the transmission lines. The larger the plant, the larger the reserve that is required.

In short, the market for MWh and the market for "spare MWh on short notice" are quite different animals.

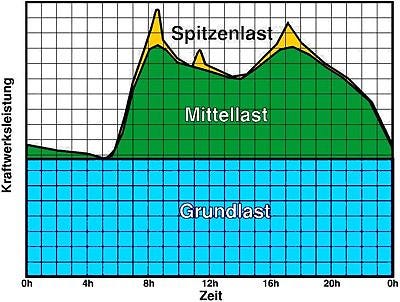

Soure: wikipedia

The Germans distinguish between permanent base load (i.e. the minimum consumption of any time, which effectively requires permanent generation, "Grundlast" in the graph above), semi-base load (or the predictable portion of the daily demand curve, "Mittellast" in the graph above), and peak/unpredictable demand (i.e. the short term variations of supply availability and demand - "Spitzenlast" in the graph above). Wind (like solar) is now predictable with increasing accuracy for day-ahead designations, and can, for the most part, be part of semi-base load; i.e., low winds can be treated just like a traditional plant being on maintenance: reduced, but expected, availability of a given asset.

The service "reliability of supply" is well-understood, and the technical requirements (having stand-by capacity for the potentially required volumes) are well-known, there is plenty of experience on how to provide them (hydro plants, "spinning reserves", i.e. gas-fired plants available to be fired up, or interruptible supply contracts with some industrial users who accept to be switched off at short notice and, increasingly, batteries and other forms of storage) and experience and the relevant regulations have made it possible to put a price on that service.

So, when there is no wind or sun, the flexible capacity is called. What matters is whether there is enough such capacity, and how often it is used. The reasonable interrogation is what happens when baseload is retired - presumably there will be a need for more such flexible capacity, but that’s not completely obvious. We are building a lot more renewable capacity than we used to have baseload capacity (in GW in each case) - that reflects the intermittency of renewables, which rarely produce at maximum - or a minimum - capacity, and, when you have different technologies and different geographies, even more rarely reach these minima or maxima at the same time.

The questions become: (1) what is the cost of maintaining (or building) the flexible spare capacity needed, and (2) what is the cost of surplus renewable electricity that may need to be curtailed at times of over-production? Both of these would detract from the value of wind.

For the first item, there are a number of known economic models to pay for capacity, whether via capacity mechanisms (the network pays for a plant to be available on standby and to generate power when asked) or via spot prices (‘peaker’ plants that bid high prices (high enough that they can be profitable even with only a few tens of hours, of generation each year). As noted above, the capital cost of gas plants is relatively low and we already have a lot of them online

For the second item, the obvious solution is to find ways to increase demand at those times of high supply. We’ve functioned with a system where supply adapted to demand, and we are going towards a system where demand will adapt to supply, with both reductions when there is not enough supply, and increases when there is too much. That includes storage, interruptible activities, as well as the ability to move around the demand for things that are not time-sensitive (such as heating water, charging cars, and many others)

In that context, the fact that wind or solar do not produce at the “right” time is actually reflected in their “capture” price - they will get a lower market price, even if under a (well-designed) CfD mechanism: if the price they actually get at the time they generate has a lower average level than the price for the full period for the whole system, they will receive a lower price. In that case, the lower value of their production (due to its poor timing) will be reflected in a lower price, and those generators that can provide power when needed will get a higher price for that service.

In any case, it is interesting to note that Germany, over the past 20 years, has replaced 40% of baseload generation - nuclear, lignite - (in MWh) by intermittent renewables, and is actually producing - a lot - fewer MWh from the flexible plants - the gas-fired and hard-coal plants. So more renewables does not seem to mean more gas-fired generation, as the opponents of wind often suggest.

Source: Energy Charts

In short: the cost to the system of integrating massive renewables (50% and counting in multiple European countries) seems to still be quite low, and thus the value of wind is not significantly lower when taking into account the impact on the power system.

Carbon emissions

The second externality to mention is carbon emissions. In that case, it is not an externality caused by wind generation, it is an externality which is created by existing power generators, which is not properly accounted for yet today, but which wind generation avoids. In other words, there is a benefit for society to replace fossil fuel-burning generation by wind, but it is not priced in yet (or, in other words, the indirect cost of coal-burning is paid by the inhabitants of low-lying islands, not to mention the respiratory systems of neighbors of the power plants, rather than by the consumers of that electricity).

Attempts to price carbon emissions are moving forward, with the European ETS (emissions trading system) and other similar systems; these require carbon-spewing generators to pay for that privilege and materialize a new cost for them, which will be added to their cost of generating electricity (but not to that of wind, as it emits no carbon dioxide in the process).

It is no less legitimate to include the cost of carbon as it is to include the cost of stand-by capacity in the calculation of the cost of electricity. If we consider the power grid as a fully integrated system, then there is very little reason to include some externalities and not others - other, that is, than force of habit and lobbying by the incumbents who designed the rules around their exiting generation mix.

Security of supply

A power plant is an investment that can last 25 to 50 years (or even more, in the case of dams). Once built, it will create patterns of behavior that will similarly last for a very long time. A gas-fired plant will require supply of gas for 25 years or more (and the corresponding infrastructure, and attached services, employees ... and lobbyists). Given worries about resource depletion (usually downplayed) and about the unreliability of some suppliers (dismissed as a minor worry, until Putin made it real…), it is not unreasonable to suggest that security of supply has a cost.

This may be reflected in long term supply arrangements with firm commitments by gas-producing countries to deliver agreed volumes of gas over many years - but this does not seem to be enough (the majority of supplies from Russia were under long term contracts). Wind, which requires no fuel, and thus no imports, neatly avoids that problem, but how can that be valued in economic terms? That question has no satisfactory reply today, but it is clear that the value is more than nil.

Another aspect of this is that "security of supply" is usually understood to mean "at reasonable prices." Fuel-fired power plants will need to buy gas or coal in 10, 15 or 20 years time and it is impossible today to hedge the corresponding price risk. Given prevalent pricing mechanisms, individual plants may not care so much (they will pass on fuel price increases to consumers), but consumers may not be so happy with the result.

Again, here, wind, with its fixed price over many years, provides a very valuable alternative: a guarantee that its costs will not increase over time. Markets should theoretically be able to value this, but futures markets are not very liquid for durations beyond 5 years, and thus, in practice, they don't do it. This is where governments can step in, to provide a value today to the long term option embedded in wind (i.e. a "call" at a low price). This is what feed-in tariffs do, fundamentally, by setting a fixed price for wind production which is high enough for producers to be happy with their investment today, and low enough to provide a hedge against cost increases elsewhere in the system (and indeed, last year, when oil and gas prices were very high, feed-in tariffs in several countries ended up being below the prevailing wholesale price: the subsidy went the other way round...).

Note again that the regulatory framework will decide who gets access to that value: if wind is sold at a fixed price, it is the buyer of that power that will benefit from the then-cheap supply. That may be a private buyer under a PPA, or the grid operator; depending on regulatory mechanics, that benefit may be kept by that entity, or have to be reflected into retail tariffs for end consumers. If wind producers get support in the form of tax credits or "green certificates", it is wind producers that will capture the windfall of high power prices. So the question is not just how to make that value appear, but also how to share it. Both are political questions to which there are no obvious answers.

:: ::

So wind power has value as a low-emissions, home-grown, fixed cost supplier. It also tends to create significant numbers of largely non-offshoreable jobs, which may be an argument in today's context. It also has, in a market pricing mechanism, the effect of lowering prices for consumers thanks to its zero-marginal cost. Its drawbacks, i.e. mainly intermittency, can be priced and taken into account by the system.

Altogether, wind seems to be an excellent deal for consumers - and an obvious pain (in terms of both lower volumes, and lower prices) for competing sources of power, except maybe those specialising in on-demand capacity.

In other words: sticking with gas or nuclear is a political choice, not an economic one.

Excellent post, quite some insights in there. Shared with others in my circle. Thanks!

Great analysis, very useful.