Suggestions to reform the German electricity market

A few "easy wins" without too much political heat

This is co-written with Andrew Eckhardt, with whom I have worked on projects for 15 years

We are living through interesting times for the German power market: the country is currently in full swing to redesign its power market to bring the EEG into line with EU mandates by end 2026 – and the recently announced general election will heavily influence coming decisions, given very confrontational positions, particularly between CDU and Green party, with party frontmen Friedrich Merz and Robert Habeck drumming for nuclear or renewables, respectively.

But there are common denominators, too. To discuss the market redesign, the (still sitting) government had introduced the Climate-Neutral Electricity System Platform (PKNS). The PKNS was designed as a forum for discussion which includes stakeholders from politics, science, business and civil society to develop relevant suggestions for Germany’s future market design. The forum is organized across four working groups: (i) ensure funding for renewable energy production; (ii) expansion and integration of flexibility options, (iii) funding of reserve capacity and (iv) local price signals. At the same time, Germany’s regulatory body for the power grid – BNetzA – plans to redesign network charges to industrial clients, starting 2026.

The importance of getting these reforms right, cannot be overestimated given the sluggishness of the German economy and the ever-more-noticeable climate emergency. Given how politized energy policy is in Germany generally, and in the context of a general election, it will be challenging to distinguish sound economic arguments from political noise.

Let us thus take a shot at identifying some reasonable guidelines for German policy makers.

As a first step, we need to define have a view of the status quo and of a target for the reforms. As a ‘simple’ target of the reforms, we suggest an “efficient electricity system”, i.e. a market that achieves carbon-efficient, reliable delivery of electric power to all consumers within a jurisdiction at the lowest possible total cost.

The current system is

already very reliable (12 minutes of average outage in 2022, compared to 21 minutes in 2006)(that should not be compromised) ,

not as carbon-efficient as it should be (171 Mt to date in 2024, or 486g of CO2 per kWh produced in Germany)(That is better than the 333 MT in 2004, or 632g/kWh, but still far from France’s 16 Mt (32g/kWh)), and

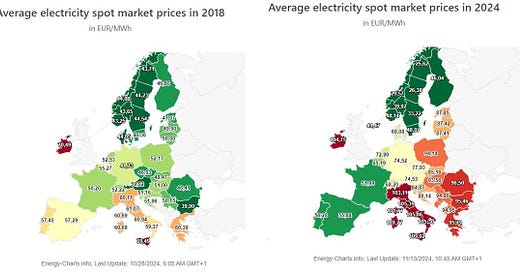

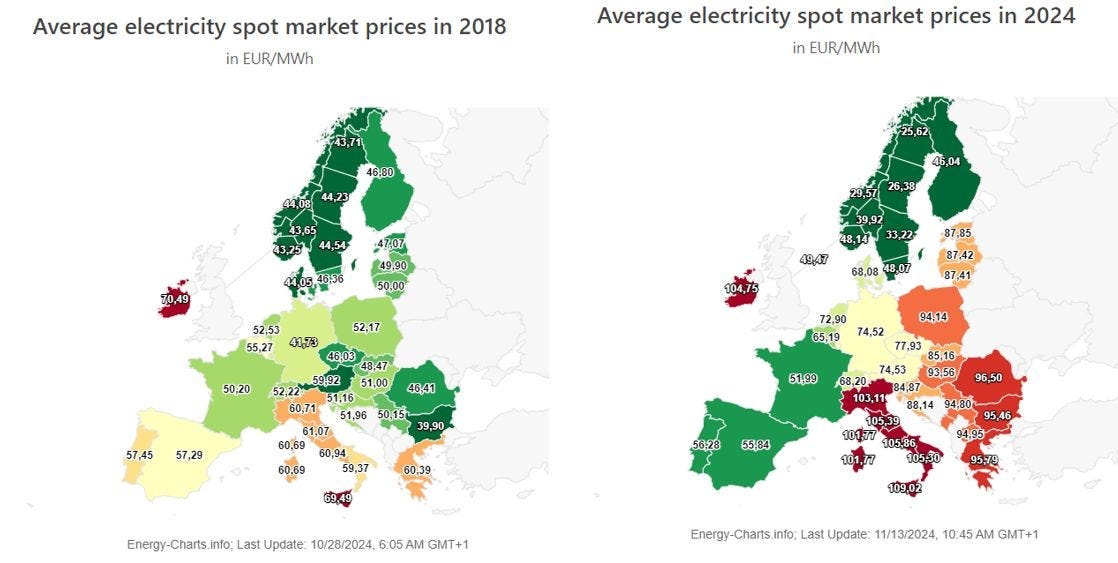

not as cost-efficient as it could be (In particular, its relative cost efficiency has significantly declined over the last few years, as shown on the map below)

Map source : Julien Jomeaux

Let’s look at power market prices first. As in any market, price is set by supply and demand – with the critical difference in the power market that supply and demand must meet each other at every instant. Given that demand is not yet very sensitive to price (more on this below), that means that supply needs to adjust to demand, with a premium for flexible capacity, and inevitable bursts of volatility (peaks of prices, or negative prices) to force supply or demand to adjust. This also means that the market price is set by the more expensive plants to provide the requisite demand, which is still, often, a gas-fired plant, making power prices very sensitive to natural gas prices.

Even though it has been decreasing for most of the past 20 years, it is generally expected that electricity demand will increase in the coming decades, as electrification is the cheapest (and often the only) way to decarbonize sectors like transport (electric vehicles), petrochemicals (electrolysis of hydrogen), steel and cement, and the increasing digitization of our economies – and the development of AI, boost the need for large numbers of computer servers Everything else being equal, that will increase prices. So, we are stating the obvious: supply must grow. In a power system where only renewables get built, and thus an increasing fraction of supply cannot be increased on demand, the tools that allow us to time-match supply and demand will have to get better – that is generally referred to as “flexibility”.

Here comes our first piece of advice, regarding supply: renewable energies do not need subsidies, nor priority access to the grid. In the vast majority of cases, they can be produced at the lowest levelized cost of energy (LCOE) – and low marginal cost, within a reasonable regulatory framework.

In fact, giving them special treatment is increasingly harmful in two ways.

First, it creates political headwinds against the sector and its supposed cost as a burden to the economy.

Second, given their already high penetration, just building out more renewables without taking into account when and where the additional production will be brought online can actually be destroying value. New power supply should be ranked at its value to the system. We believe that a concept such as Levelized Cost of Load Coverage" (LCOLC) as developed by German economist Veronica Grimm can be beneficial in this context to quantify the value of new supply to the grid.

Thus our second piece of advice to achieve a carbon-efficient Electricity System: let the European Trading System for carbon emission do its job in the German power market. If it creates a level field (still a work in progress given the exemptions and the difficulty to control imports of carbon-rich products), it is the friend of renewables expansion at this stage – and any micromanagement beyond its uniform mechanism will rather be harmful to renewables – and if it were only in terms of political cost.

What utility-scale renewable power projects need, like any other infrastructure investment, with heavy upfront investment i.e. like any nuclear or coal-fired power plant, railway line, large building, etc… is competitive cost of capital.

To achieve low capital cost, an infrastructure asset will require predictable cash flows – and that, in our view, is most efficiently achieved for power generation with no fuel cost via a fixed long term power price. Given that no market exists for such prices (contrary to fixed long term interest rates, for instance), it must be created, and the best way to do that is via the allocation of two-sided contracts-for-differences (CfDs) on competitive terms. CfDs are contracts where a price is agreed for the duration and the grid operator, or another regulated entity pays the difference between that price and the spot market price (if spot it higher) and receives it (if spot is lower. This provides revenue stability for producers, allowing them to attract cheap funding, and in turn to have a low cost of production. It also provides cost certainty for consumers – in that case all ratepayers in the market benefit from having a fraction of overall generation at a fixed price for a long period.

Third piece of advice: offer well designed”differentiated CfD-contracts” to any utility scale new built, taking LCOLC into account at least by way of a proxy. One way to achieve that proxy may be to give a specific advantage in the evaluation of price for specific bidders in CfD auctions, linked for instance to location (example for Germany: higher in the South, lower in the North), time (higher in peak demand times by hour or season), technology (as Germany is intending with its call for 10 GW of H2-ready CCGT (and we are not judging here if that makes sense)) or other indicators that reflect a market imbalance that should be corrected rather than amplified.

Residential solar has now become so large that it drives power prices significantly. The problem is two-fold: hardly any households in Germany have smart meters and no-one has an incentive to align own production and consumption in line with the needs of the overall Electricity System. Thus our fourth piece of advice: speed up the role of smart meters – the current target date for 100% smart meters is 2032 – which is much further away than is necessary – and achievable.

We’d suggest lowering the technical requirements and to simply subsidise the initial installation, if it happens by end 2026, and is linked to any generation system in the household. Germany has around 50 million meters, about 99% have not been upgraded. Let’s say a plain EUR 50 paid to any household who can evidence by end of 2026 that they have installed a smart version. Just the grid build-out that can be avoided that way probably costs way more than the EUR 2.5 billion investment (and would take a lot more time).

This will allow business models that help residential households to time their demand more flexibly. Being flexible is in many ways much easier (and therefore cheaper) for households than for industry – many domestic power uses are temporary and easily moved around to a decent extent (think heating your water tank, washing your clothes or charging your electric car). This could also encourage local storage systems that allow households to benefit even more from their installed solar panels. For residential, we believe that – with smart meters – the economic incentives for building storage will be sufficient with any additional compensation mechanisms.

Our fifth piece of advice then is around utility-scale storage (stand alone or integrated in supply projects): we suggest tenders run by the grid operator (as storage will always be most efficiently managed at the widest level, where all local imbalances in demand and supply have been netted off against each other already) based on availability payments against a certain target IRR for a defined total of MWh. The upside of being able to benefit from (local) power scarcity prices, will provide economic incentive for investors to build in the right location to secure economic upside.

Our sixth piece of advice is then to BNetzA – the direction of your consultation is absolutely correct – but taking the steps focused on the residential market first will minimize the need for industrial market participants to increase their flexibility. For the rest, our advice is to incentivize industrial offtakers to by a relatively simply discount scheme, similar to what has long existed in France with demande effaçable(cancellable demand): you get a lower price for your electricity at all times if you agree to be cut off by the grid, with limited notification periods, in times of system stress. If you can additionally increase your demand upon request, you also get a discount. The discount should be less than what it would cost the grid to build additional capacity or the penalties it has to pay to curtail supply. Companies that can adapt their production processes or install storage and profit from the discount will help improve the system in a cost efficient way.

As a final note, let us share our views on two aspects continuously under discussion: capacity markets and corporate PPAs.

Capacity markets are a form of insurance against exploding power prices in times of high demand vs low supply, which are always politically sensitive. But this insurance tends to come at a very high price: it distorts markets and the insurance premium usually is quite high (and it can also be used as a political tool by claiming that plants are paid “not to produce” most of the time).It is cheaper to have investment in just a few “peakers” – which only get compensated per MWh and only do so when power prices are extremely high (with a well-known business model that has historically been financed willingly by banks). To give a simple comparison: when you arrange a wedding, paying the pub a flat fee for unlimited drinks for the whole evening will usually turn out to be more expensive than just paying drinks as consumed – simply because the pub owner usually know their business and the flat fee will be high enough). Of course, capacity markets may be easier to defend for regulators (just as you may agree on the flat fee regardless, just for your peace of mind at your wedding), and utilities will tend to lobby for them (which tells you something about their profitability…) but the discussion should be had.

Similarly, we would like to point out the downsides of corporate PPAs. They essentially allow strong offtakers (think Microsoft, Google or, to a lesser degree, BASF) to secure the best, cleanest and cheapest power at the lowest cost (based on their quality as financially strong counterparties, renewables projects can achieve the best possible financing terms). That cost is still higher than what the regulator can achieve via a CfD (see here the BASF example). But, unless these solutions are behind the fence, these corporates still benefit from the grid – both technically and in terms of a back-up. Plus, they leave the rest of the economy more exposed to “worse” energy, including price shocks from gas prices etc. So, while we fully understand the corporate reflex on offtaker and developer side pro corporate PPAs, we believe that far too little notion has been put towards the systemic effect of such arrangements.

Overall, we believe that this handful of relatively straightforward measures could materially enhance the transition towards a low-carbon Electricity System at low cost. The Energiewende gets a bad rap in the English-language press, even though it has helped create a competitive renewable energy industry from scratch – something the whole world benefits from, even though mostly German ratepayers pay for it. Our proposed reforms would help reduce that last item.

A key component to me is using all the domestic batteries installed by PV owners to help balance the grid in winter. Even if you are on a dynamic tarrif like Tibber the high fees per kWh (and absence of domestic dynamic export tariffs) mean that households optimize for their domestic consumption rather than the grid.

I'm thinking something like Octopus agile where fees per kWh are only added to spot market prices in times of grid congestion could be very benefitial

some good suggestions here - but some sound a bit too much lke locational pricing to me in a way that shows up locational pricing's faults. You say give higher CfD prices in the South - but that's precisely where there are less wind power resources, at least in terms of ability to get planning consent. This illustrates the weakness of locational pricing with renewable energy and threatens to reduce oppotunities for renewable energy developers to set up in places where it is realsitic to get schemes going. So we end up with less renewable energy. Not good.