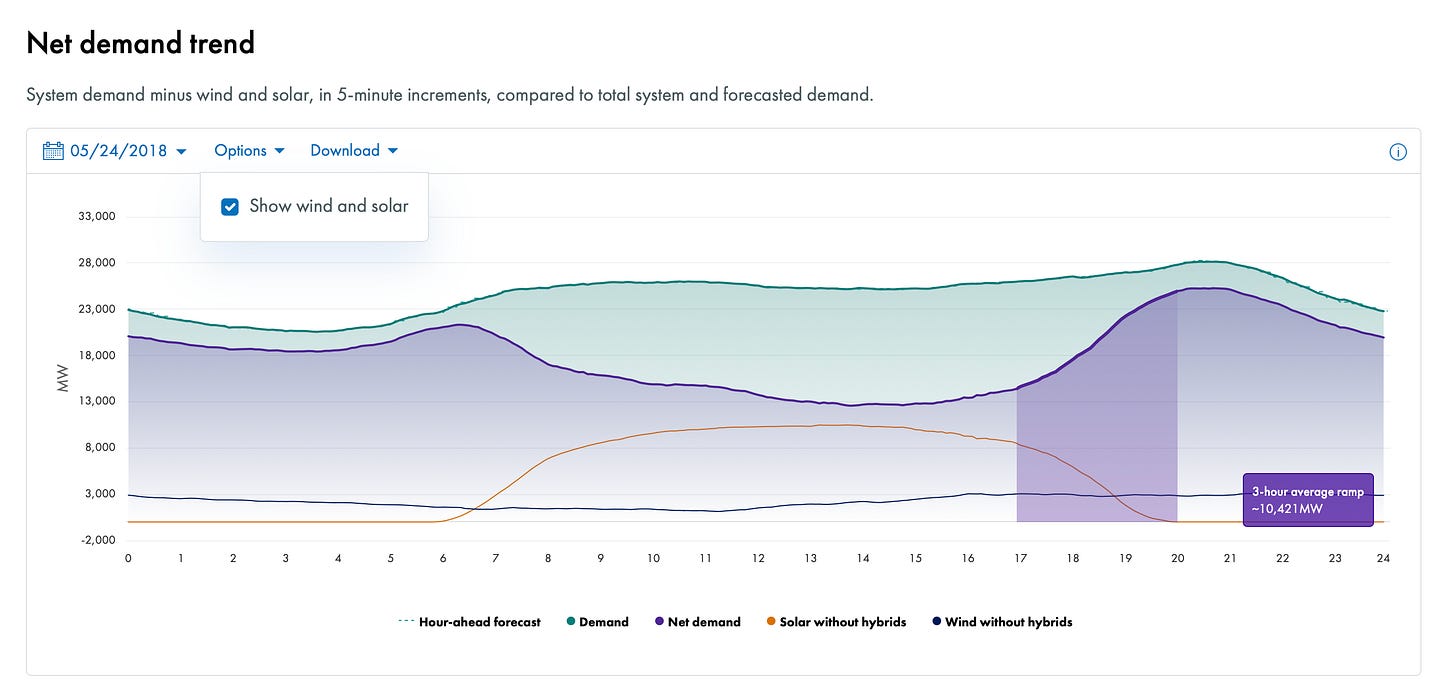

I’ve written multiple times about how solar is increasingly dominating supply during the day, across increasingly large parts of the year (and Julien Jomeaux is documenting that in even more detail on his website), and the two curves below, which show demand, solar, wind, and net demand (demand minus solar and wind) in California yesterday, and the same mid-May Thursday in 2018 , show the size of the change:

Both from Caiso (California’s system operator)

The increasing impact of solar is obvious, going from 40% of the peak to close to 100% on its own. With wind, renewables are above 100% for several hours.

As Mark Jacobson of Stanford University documents regularly on Linkedin, this is not a one-off:

58 straight and 99 of 131 (76%) days in 2025 where WindWaterSolar supply has exceeded demand in CA, for an average of 4.4 h/day and max of 9.8 h/day among all days in 2025.

And it’s not even a spring/summer thing - the 100% were reached as soon as mid-February this year in California.

As I’ve pointed out before, this is increasingly managed via the large and growing battery systems, which can now deliver up to 10 GW in the evenings, and significantly reduce the need for gas-fired generation during the evening peak, as shown in the graph below (same source).

But this is not actually what interests me today. When you look at the first two graphs above, what strikes me the most is that while peak demand in the early evening has grown a little bit (from 28.1 GW to 30.2 GW, so barely 7.5% in 7 years), and demand at night has also grown a bit (from 20.7 GW to 22.1 GW at 4am, ie + 6.8%), mid-day demand has actually plummeted from ca. 25 GW in 2018 to ca. 20 GW only in 2025, a ca. 20% drop.

So two conclusions:

Despite all the hype about AI and date centers, it’s still not significantly impacting overall demand (Amory Loving of the Rocky Mountain Institute has a good recent paper about the risk of a bubble in new generation capacity caused by the AI hype and that won’t actually be needed):

In 2023–24, artificial intelligence (AI) was suddenly hailed as the vital foundation of the next economy. Big Tech giants, aided by 36 states’ subsidies, are investing a trillion dollars in data centers for AI services. Forecasted electricity use soared, but actual national use hasn’t. In 2023, US grid electricity fell; in 2024 it rose 2%, the fourth-fastest rate in the past decade, as data centers’ share (little from AI) crept up from 4.4% to 4.5%. Electricity growth was real in a few hotspots, but was widely misreported as a national trend.

There’s something else at play: demand is actually there, but it’s been covered by behind-the-meter supply and no longer gets to be included in system-level demand. It’s striking that demand is missing in the middle of the day, right when there’s the most sun: the logical conclusion is that it’s fulfilled by residential solar. That phenomenon is obviously hard to measure, and will only get bigger as (i) more people instal storage systems together with their solar panels, and (ii) the C&I (commercial & industrial) sector does the same - putting solar panels + storage on/within industrial or commercial buildings, and procuring their power locally and increasingly, outside the grid.

That last trend is going to be highly disruptive, as it’s now driven by self-interested economics (which increasingly work even without subsidies, given the fast-dropping prices for both solar system and batteries), and it’s completely dispersed. It’s not about utility-scale plants (which can be anticipated and managed by the system - including delayed or blocked), but about apparent demand elimination, and it empowers individuals and small players against the large corporate or public bodies that have traditionally called the shots in the power sector.

The logic of the grid used to be that it is easier to manage residual imbalances at the grid level, after setting all local differences off (if the transport capacity allows it), rather than doing that locally and inefficiently (where you need to manage lots of local positive or negative balances individually), but the cost of the new technologies, and the flexibility of battery systems, upends that logic and makes the local level optimization increasingly competitive, especially for parties that function at the (higher) retail price level - especially as grids are increasingly congested and do not fulfill that role of balancing local discrepancies as well currently, due to the scale of the investments needed and the hard work of permitting what’s needed.

The risk is that this leaves the grid system with an hollowed out demand base, and permanently responsible for occasional backstop services while not providing a lot of volume anymore. It may never come to that - in fact, most residential and C&I demand is not constant, and it follows a strong day/night pattern that matches very well with solar complemented by batteries. California is also showing that, at least in some places, seasonality will not be an issue either (although that’s likely to remain a more difficult topic in places like Northern Europe, even if wind will help there).

In any case, we are moving towards a new world, where utilities and the grid face a completely new situation, where local demand will increasingly have as a credible alternative to go off-grid, and individual / local demand could become an arbitrage opportunity for enough self-reliant local parties that it puts serious price pressure on the old incumbents.

I expect more renewables+batteries and cheaper electricity, whatever policies we see. That in turn will make electrification more compelling and may finally drive power use up over time.

Thanks for this column and for the excellent education on wind power in your others. For the long-term trajectory *in rich Westernized countries* I recommend Liebrich's discussion[1] which adds some detail. Beware Jacobson's prophecies, which don't grapple with the political-economic complexities as Liebrich's do. C.f. https://gregor.us 's excellent work on the persistence of fossil fuel long-term across the world.

You are absolutely correct on the risk of hollowed-out demand; note also that billing structures are designed for high-inertia turbines and arbitrary peaks rather than instant-dispatch batteries and predictable evening peaks.

A simple way to estimate the contribution of rooftop solar is to look at the Caiso demand trend[2] on 8 April 2024 (just after the equinox), when there was a partial eclipse. It jumped about 5GW above trend line an hour before solar (not clock) noon. We also know that California has about 20 GW each of utility-scale and behind the meter solar, and that each is growing about 2GW annually. We had negative demand on the last *winter solstice*! We are deploying storage incredibly fast, but not fast enough to keep up with solar, which means ...

... everyone should ask the question: "what can we do with an absurd overabundance of power 4 hours/day"? One maximalist answer is Terraform Industry's.[3] You can be less ambitious and still exciting ...

[1] https://mliebreich.substack.com/p/decarbonizing-the-last-few-percent

[2] https://www.caiso.com/todays-outlook/demand and set the date pulldown

[3] https://terraformindustries.wordpress.com/2024/10/04/terraform-industries-master-plan/

Hello Jerome

You say the logic of distributed battery + solar being so cheap will mean this trend will continue, which I agree with, given the current cost analysis.

But isnt this just an artifact of how electricity is priced for individual consumers? If real mid-day market electricity costs (=0€/MWh) were even slightly reflected in consumer billings, the cost analysis would be completely different